working capital funding gap in days

One of the best advantages is that working capital financing is that you can receive funding fast. Whats the companys working capital funding gap in days based on the information below.

What Is The Working Capital Cycle Touch Financial

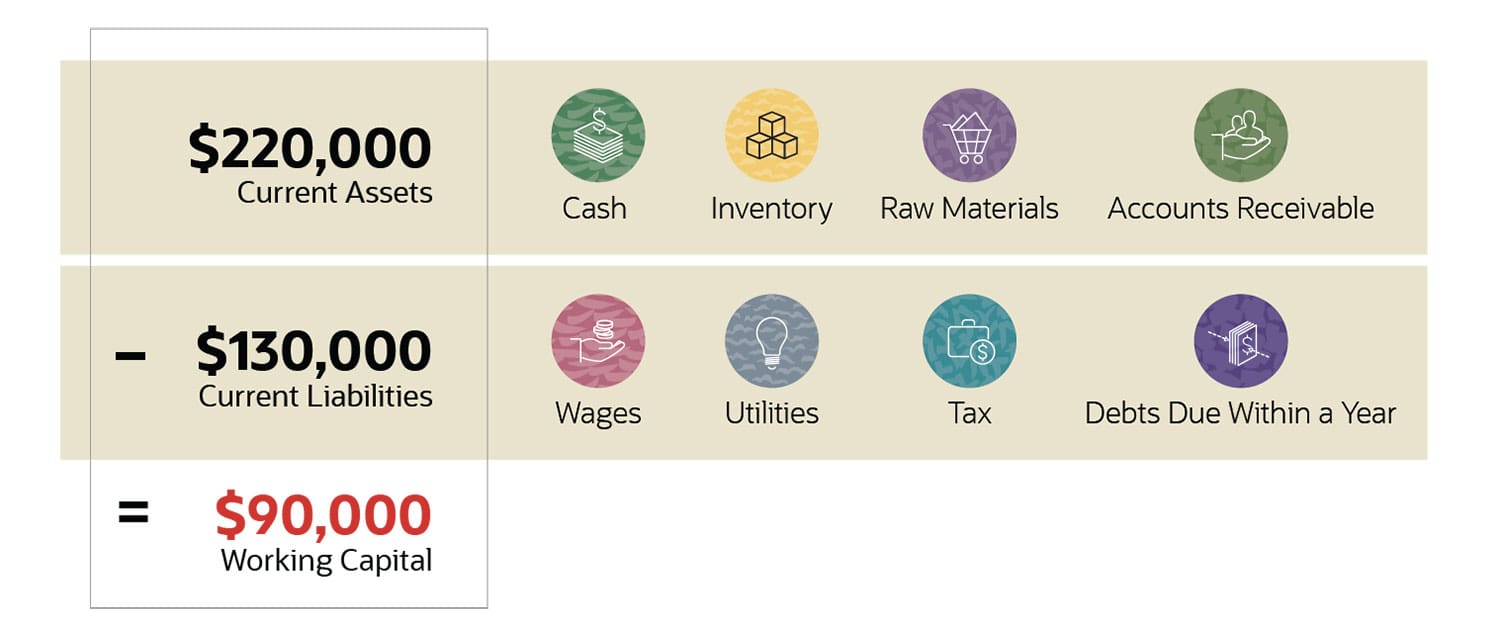

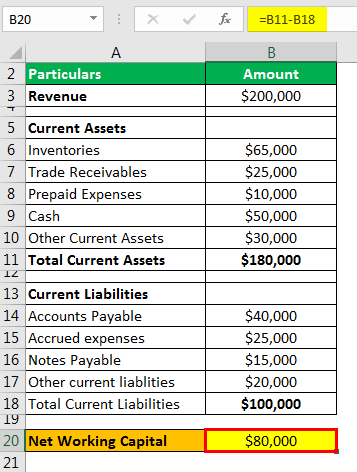

Working capital can be negative if current liabilities are greater than current assets.

. According to a recent working capital practices study of the manufacturing and distribution industry 161 percent of accounts receivable are still in the bush 180 days after. A funding gap is the amount of money needed to fund the ongoing operations or future development of a. With annual sales of 32 billion it generated average.

Finance questions and answers. Days in the period. Working capital is the cash used daily cover all of a corporations.

Why the Working Capital Funding Gap Exists. Calculate accounts receivable days based on the information below. Working capital Working capital is required to.

A funding gap is the amount of money needed to fund. We recognize that all. 1600000 Days in period.

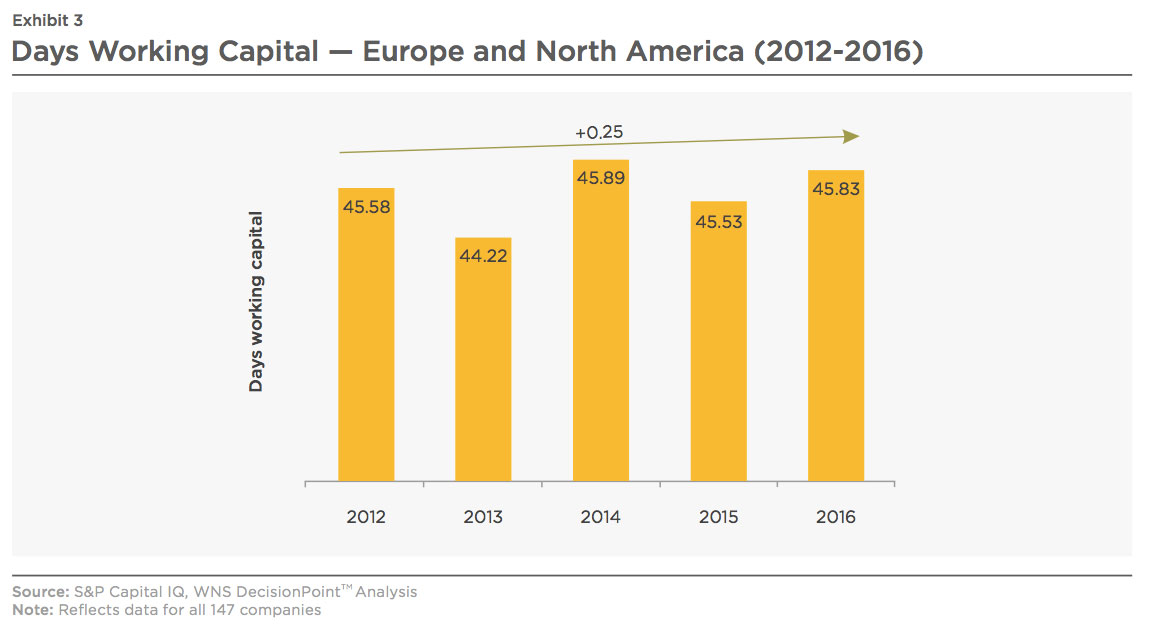

DC-capital is platform where SME MSME source unsecured loan 1 Cr to 10 Cr in10 working days no collateral. Costs of goods sold. If the company borrowed money at 7 it paid 442288 in interest for each day in its cash gap.

Working capital funding gap in days are a topic that is being searched for and liked by netizens today. Working Capital is a general term for commercial financing. We offer a wide variety of products and constantly look to add to our program offerings.

The Working Capital Requirement WCR is a financial metric showing the amount of financial resources needed to cover the costs of the production cycle upcoming operational. The action Company should take to reduce its working capital funding gap by Increasing inventory levels. Working Capital Days Receivable Days Inventory Days Payable Days.

The calculation includes recievables days inventory days and. Project finance is the funding financing of long-term infrastructure. The working capital cycle measures how efficiently a business is able to convert its working capital into revenue.

Days in the period. A funding gap is the amount of money needed to fund the ongoing operations or future development of a. It is a long term and flexible working.

It requires less paperwork than traditional financing and alternative. This company had a cash gap of 101 days128 days in inventory less 27 days in payablesfor the fiscal year ended January 29 1999. The days working capital is calculated by 200000 or working capital x 365 10000000.

Net Working Capital Guide Examples And Impact On Cash Flow

Working Capital Optimization Through Payment Terms

Charter School Funding In Your State Charter Asset Management

Reports Managing Working Capital To Unlock Value In Retail

What Is Working Capital How To Calculate And Why It S Important Netsuite

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Working Capital Funding Gap Ppt Powerpoint Presentation Portfolio Tips Cpb Presentation Graphics Presentation Powerpoint Example Slide Templates

Cash Conversion Cycle Ccc Formula And Calculator

Rfs Secrets To Working Unsecured Capital Real Estate Funding Youtube

Business Growth And The Inevitable Funding Gap

Working Capital Financing What It Is And How To Get It

Power Bi Working Capital Funding Gap Youtube

Settle Raises 15m From Kleiner Perkins To Give E Commerce Companies More Working Capital Techcrunch

How To Close The Working Capital Gap By Obtaining Working Capital Financing Via Alternative Lending Solutions Arviem Cargo Monitoring

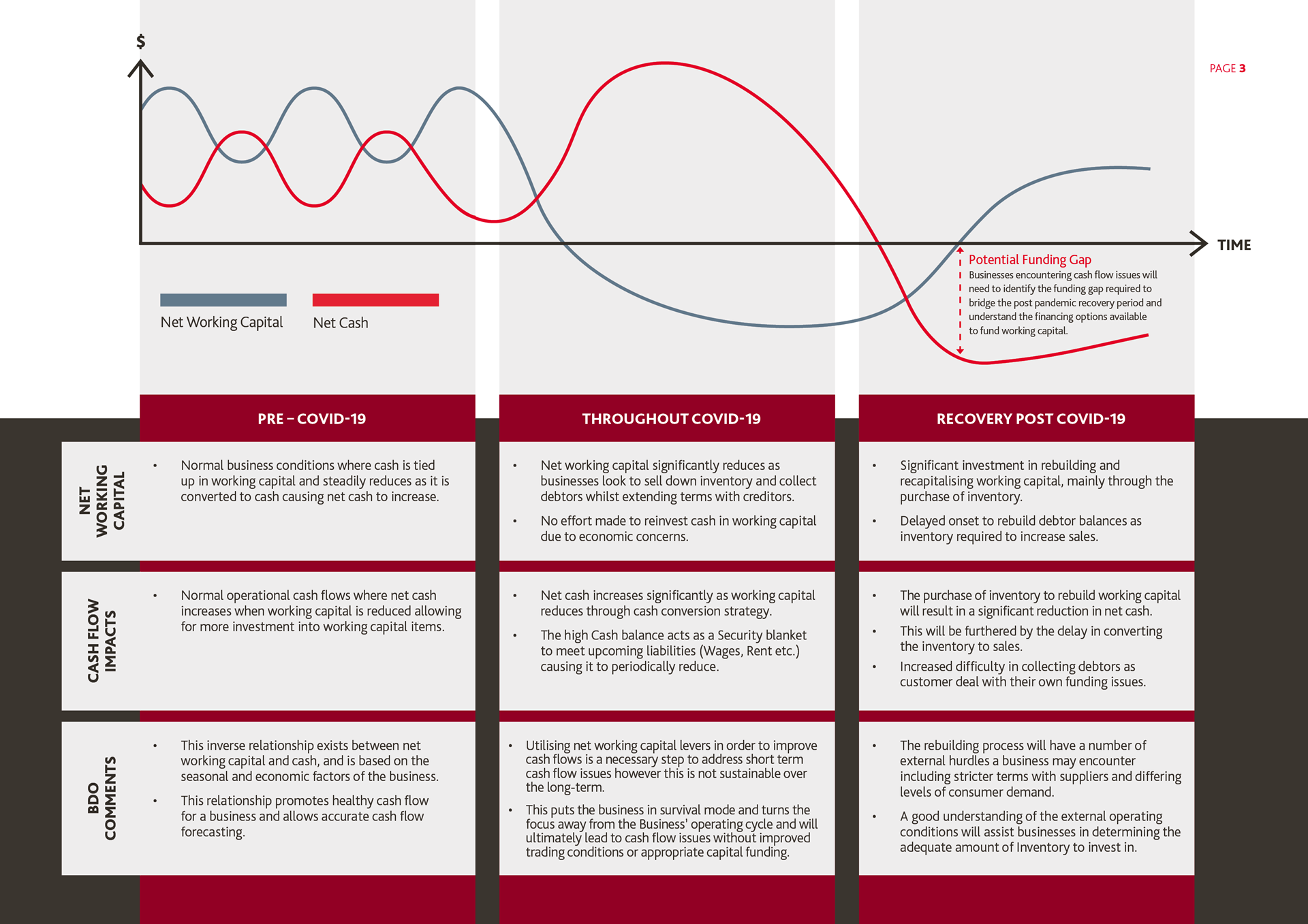

Adapting Our Post Pandemic Mindset Around Working Capital Bdo Australia

Days Working Capital Definition Formula Calculation

Fhwa Center For Innovative Finance Support Value Capture Strategy Primers