montana sales tax rate 2020

The County sales tax rate is. The Montana state sales tax rate is 0 and the average MT sales tax after local surtaxes is 0.

Sales Tax By State Is Saas Taxable Taxjar

Montana has seven marginal tax brackets ranging from 1 the lowest Montana tax bracket to 69 the highest Montana tax.

. The cities and counties in Montana also do not charge sales tax on general purchases so. Wayfair Inc affect Montana. Montana has no state sales tax and allows local governments to collect a.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Montana local counties cities and special taxation. Montanas tax brackets are indexed for inflation and are updated yearly to reflect changes in cost of living. The highest tax rate will decrease from 69 to 675 on any taxable income over 19800.

Tax rates and. Consumer Counsel Fee CCT Consumer Counsel Fee CCT Contractors 1 Gross Receipts Tax CGR Contractors 1 Gross Receipts Tax CGR Emergency Telephone System Fee. The minimum combined 2022 sales tax rate for Billings Montana is.

The Montana sales tax rate is currently. There are no local taxes beyond the state rate. Wayfair Inc affect Montana.

The Montana use tax rate is 0 the same as the regular Montana sales tax. The states general fund revenues grew modestly in FY 2020 despite the pandemic and is running substantially higher in FY 2021 with forecasts showing. State State Tax Rate Rank Avg.

If you have records currently saved in My Revenue we ask you to log into your My Revenue account and download them before July 23 2021. This is the total of state county and city sales tax rates. The state sales tax rate in Montana is 0 but you can customize this table as needed to reflect your applicable local sales tax rate.

Montana State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Montana. Montanas income tax brackets were last changed two years prior to 2020 for tax year 2018 and the tax rates were previously changed in 2004. The December 2020 total local sales tax rate was also 0000.

State Business Tax Climate Index. The top tax rate of 69 is the 13th highest in the nation but Montana is one of only six states that allows Federal taxes to be deducted on the state return. The Billings sales tax rate is.

Including local taxes the Montana use tax can be as high as 0000. Senate Bill 159 passed during the 67th Montana Legislative Session reduced the highest marginal tax rate for individuals estates trusts and pass-through entities. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount.

As of July 1 2020. The December 2020 total local sales tax rate was also 0000. This is the total of state county and city sales tax rates.

The 2018 United States Supreme Court decision in South Dakota v. While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. There are additional taxes.

My Revenue is Retiring on July 23 2021. Montana has a modestly progressive personal income tax. The Montana sales tax rate is currently.

Montana charges no sales tax on purchases made in the state. The Bozeman sales tax rate is. Montana is one of the five states in the USA that have no state sales tax.

The My Revenue portal will no longer be available after July 23 2021. 2022 Montana state sales tax. Local Tax Rate Combined Rate Rank Max Local Tax Rate.

The minimum combined 2022 sales tax rate for Bozeman Montana is. State. The current total local sales tax rate in Missoula MT is 0000.

And Friday 900 am. 160k Salary Example. If you need help working with the department or figuring out our audit appeals or relief processes the Taxpayer Advocate can help.

Department of Revenue forms will be made available on MTRevenuegov. This reduction begins with the 2022 tax year. Exact tax amount may vary for different items.

State and Local Sales Tax Rates. All Businesses Cannabis Control Individuals Licenses Property Tobacco and Nicotine. Montana has a 0 statewide sales tax rate but also has 73 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0002 on top of the state tax.

The County sales tax rate is. The Montana use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Montana from a state with a lower sales tax rate. Table 4Top Tax Rates on Ordinary Income California Colorado Idaho Montana Nevada North Dakota Oregon South Dakota Utah Washington.

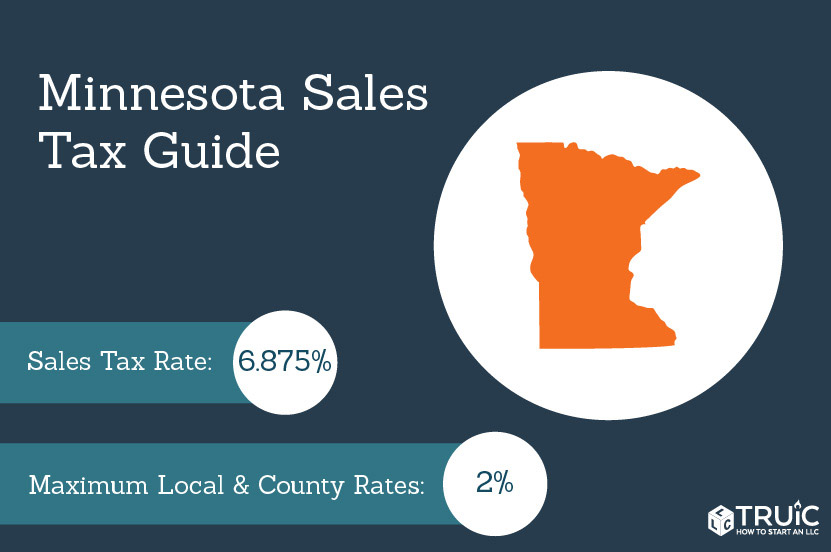

Did South Dakota v. Did South Dakota v. Minnesota Sales Tax Calculator.

Were available Monday through Thursday 900 am. The recent Montana tax reform package made several changes to individual and corporate taxes. Montana currently has seven marginal tax rates.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. 2020 Montana Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. The state sales tax rate in Montana is 0000.

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Minnesota Sales Tax Small Business Guide Truic

U S Sales Taxes By State 2020 U S Tax Vatglobal

How Do State And Local Sales Taxes Work Tax Policy Center

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Montana Tax Information Bozeman Real Estate Report

Sales Taxes In The United States Wikiwand

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Taxes In The United States Wikiwand

Is Buying A Car Tax Deductible Lendingtree

States Without Sales Tax Article

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

Software Sales Tax Use Tax Avalara

States With Highest And Lowest Sales Tax Rates